Accounting Oil and Gas Production at Sait,Canada

Content

Our team of measurement and production accounting professionals stays plugged into the digital volumetrics ecosystem and emerging products in the space to help your team easily navigate all of the options, select, implement, and manage change. Production Accountants are tasked with shoring up actual vs planned reports on oil production and operational costs. Understanding, and more importantly, forecasting well performance, gives production accountants opportunities to troubleshoot issues before they impact monthly figures.

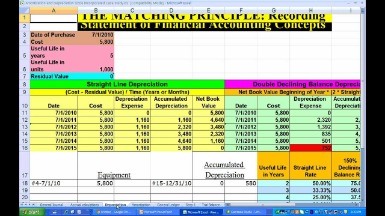

Typically, there is a correlation between the amount of G&A spent and the amount of attainable detail. Luckily, the industry is doing a great job of utilizing technology to eliminate tedious, non-value-added tasks. These improvements should ultimately lead to being more efficient with fewer resources, but it’s still a work in progress. Traceability of feedstock batches including reception, blending, and manufacturing processes is key to refiners, especially in bio-fuels.

Programs

The NUPRC boss explained that the focus of the agency included business continuity and low cost of production, accurate measurement and timely payment of royalty, uninterrupted supply of crude oil and gas as well as safety of the environment. With sustained global demand for hydrocarbons and new complexities from the energy oil and gas accounting transition , the industry will be increasingly called to adopt new solutions as it evolves to meet society’s needs. In this journey, much work has already been done to improve drilling performance and recoverable reserves from oil and gas wells, accelerated by the advent of digital technology throughout the value chain.

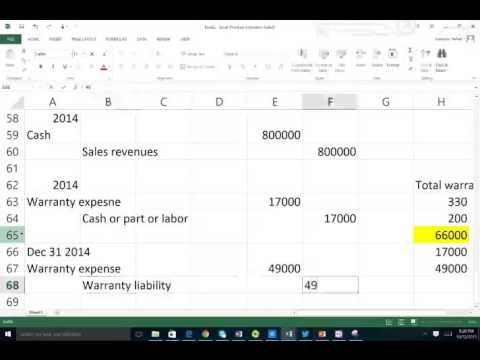

The reason that two different methods exist for recording oil and gas exploration and development expenses is that people are divided on which method they believe best achieves transparency of a company’s earnings and cash flows. PSA apportions user-entered production volume and revenue to cover various types of cost for production sharing agreements. Production volumes can be entered directly in PSA, and PSA calculates revenue by multiplying user-entered price per unit by these volumes for the various petroleum products of a production sharing agreement. With so much data being presented in bits and pieces, it would be critical for the solution to bring that information together into something coherent.

Successful Efforts vs. Full Cost

PSA also incorporates a comprehensive and configurable set of

calculation rules used in computing the various amounts related to the agreement between the government and the contracting company. During PSA calculation processing, all costs, including government royalty, are re-stated as amounts of production volume and revenue. The SAP Production Sharing Accounting system (PSA) supports the

reporting requirements for government royalty and contracting company cost recovery of petroleum exploration and production projects that oil companies undertake in developing countries. The time from when the field personnel input the allocation information to it being processed for analytics was reduced to approximately 25 min. or less using the JOYN platform, a task that previously took two days—and, in worst-case scenarios, up to a week, Fig.

Aggregate calculation results can be produced for all products in a production sharing contract. For the purposes of documenting SAP’s Production Sharing Accounting system, the term

PSA is used to refer to the system itself. The term

PSC is used to refer to the master data object for the production sharing contract. It is widely used in oil, gas, mining, and other commodity-based sectors, and it often produces more accurate results than the standard DCF analysis. One downside of the full cost method is that you need to test the PP&E balance every so often and apply write-downs if the book value gets out of line with the market value – so write-down and impairment charges are common on full cost companies’ income statements.

Digital Operating Models

For cases where the company is highly diversified – think Exxon Mobil – you need to value its upstream, midstream, downstream, and other segments separately and add up the values at the end. I hinted at this in the last part of the NAV explanation above, but sum of the parts is a very common valuation methodology in the energy industry. You add all those up to arrive at Enterprise Value, then back into Equity Value the normal way, and calculate the company’s Implied Share Price by dividing by the diluted shares outstanding. Then, you add up and discount everything based on the standard 10% discount rate used in the Oil & Gas industry (no WACC or Cost of Equity here). And then you deduct this production from their reserves… and (hopefully) replace it with sufficient CapEx spending, linking the dollar amount of that spending to a specific amount of reserves. Listen, learn, and apply technologies to solve a wide variety of water and process treatment needs, utilizing the broadest and deepest product portfolio in the industry.

- PSA

classifies and tracks costs for petroleum production projects in which government entities have a royalty stake, contracting companies recover costs, and net production volumes or profits are distributed to either or both parties. - Under the Full Cost method (FC), most exploration and development costs are capitalized by an aggregated “cost pool” regardless of the outcome.

- Field data capture alone represents a category of more than a dozen solutions, some on-premise and others cloud-based and mobile.

- Visual MESA Production Accounting and Yokogawa ROTAMASS Total Insight is a unique and efficient solution for near real-time production tracking and well testing assistance.

- Confidential data integral to the entire oilfield operation could be sitting on a local hard drive or someone’s desk, further increasing the chances of a security breach.

We are a forum for the active exchange of ideas which result in innovative business and accounting solutions. At the same time, they manage new well and pad set ups in their hydrocarbon accounting system, ensuring that allocation scenarios comply with commercial, regulatory, https://www.bookstime.com/ and measurement requirements. If there is a major acquisition, the PA will also be responsible for ensuring that all the information required to process allocations is available and has been correctly integrated from whatever system the acquired wells were in before.

What you Should Know About Oil & Gas Accounting

The JOYN platform, then, was able to leverage its foundational abilities to support an entirely different functional discipline at the company. An operator focused on the western portion of the Eagle Ford shale in South Texas wanted to improve the effectiveness of gathering field operations data, in turn allowing the producer to improve operational efficiency. An area that was identified as needing to be optimized was their allocation processes and reporting for production data.

What skills do you need to be a production accountant?

Production accountants require much experience in accounting processes and budget management. Their technical skills may include recording transactions, maintaining the general ledger, creating financial statements and budgets, working with auditors and closing the books at the end of production.

Additionally, obstacles with issues like inventories were almost eliminated, and backend components were consolidated into user-friendly dashboards. The operator is also leveraging the JOYN platform to capture and retain corporate knowledge, enabling new employees to quickly get up to speed and ensure critical allocation processes. Once implemented, the operator found that the platform’s data management structures allowed the company to capture field data in a consistent, scalable way, building a foundation for more effective production allocation. In addition to delivering information to relevant users in a timely fashion, the company was able to join the myriad IT structures—servers, storage, infrastructure, and Wi-Fi in the field—necessary to bring data from the field to the office.

Digital Core Capabilities

Calculation formulas are delivered with PSA for all standard calculation categories required for production sharing contracts. The operator migrated more than 1,800 of the 2,300 wells in one of their assets to the JOYN platform, setting the organization up to better manage the critical field data that drive daily allocation and production reporting processes. Baker Tilly’s online systems and services can streamline back office operations for independent operators, investors with a portfolio of non-operated working or royalty interests or brokers of oil and gas investments.

“We understand the importance of oil and gas production to this nation, over 200 million Nigerians depend on what accrue from this production. Komolafe added that as the regulator of both the technical and commercial aspects of the upstream sector of the petroleum industry, it was important for the NUPRC to highlight the above to ensure optimal revenue generation for the country. The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has re-emphasised the importance of accurate accounting in Nigeria’s oil and gas Industry. Lease operators were of particular importance, as they followed daily well routes, performed inspections, conducted well tests, and safely ensured that production was stable and continuing to improve. Supporting the boots on the ground and enabling their success meant providing the right tools and data to make the right decisions and have full visibility into their production.